When one login can tame 78 tigers at your door

Debt claims from 78 different collection companies? That can feel like a whole pack of tigers roaring from the mailbox. Now you only need to tackle one.

Losing track of your finances is easier than you think. And a lot harder to fix. Even professional debt advisors struggle. Until recently you would have to log into or contact 78 different financial institutions for a definitive answer to a basic question – who do I owe money? What’s worse, some of these institutions aren’t even online yet. How can people paralyzed by fear of the financial mess they’ve made be expected to deal with it, if even the pros struggle?

The answer involves handling your digital identity. But first, another kind of fire:

– We met a man who uses the collection letters he receives in the mailbox to light up his fireplace, says Lene Drange, CEO of the new platform Inkassoregisteret.

Together with partner and co-founder Hallgeir Kvadsheim from the popular TV3 series “Luxury Trap”, a show that helps people in financial trouble sort out their spending, they have seen a need for a common, simple and digital platform. One that can gather debt information from the many different agencies contacting Norwegians to repay all the money they owe. And that is a whole lot. Only counting consumer- and credit card debt we owe 110 billion right now. 3 500 billion if we count mortgages for homes as well. Norwegians are “world champions” in consumption. And it is precisely consumer loans that are most often forgotten. Or hidden.

– Some people hide the letters they get from themselves. It could be in the attic, in the car, a baby bathtub or in a closet. But few get rid of them completely. Because then they think they are somehow doing something illegal, as many have the intention of paying back what they owe, says Kvadsheim.

And some, obviously, use the paper for heating.

# Being met by debt again and again hurts

It hurts to be exposed to stress for every letter that lands in the mailbox.

A lot of the agony comes from the fact that it is quite difficult to keep track of the problem.

– There is a constant flow of new and strange solutions when it comes to how the collection companies operate. Some banks can also be quite cynical and make the process troublesome. Sometimes people borrow money from abroad without even being aware of it themselves. So we often end up discussing these things with professionals at NAV (Norwegian Labour and Welfare Administration) for instance, who we collaborate with, says Drange.

– Soon we want Inkassoregisteret to also be able to help professional advisors with all the information they need in seven seconds, not seven weeks, which has been the reality, says Kvadsheim.

# Only deal with one tiger, not 78

As many as 78 debt companies in Norway send out these dreaded “window envelopes''. And not because of the view. They’re named after the transparent bit that shows your name and address printed on the included invoice. Everyone knows what bills look like. Nobody wants to open the envelope, although most do. Every time one of them appears, panic grows for those who know they’re in trouble. It triggers shame and primal fight or flight responses, to even approach the letter box. Some think, ”I'll end up in prison".

It is scary to be asked for money that you may not be able to pay back. No one is good at facing “78 tigers” on their doorstep as a daily routine. So, imagine not having to face the "tiger at the door" time and time again. Better just deal with one tiger. Once!

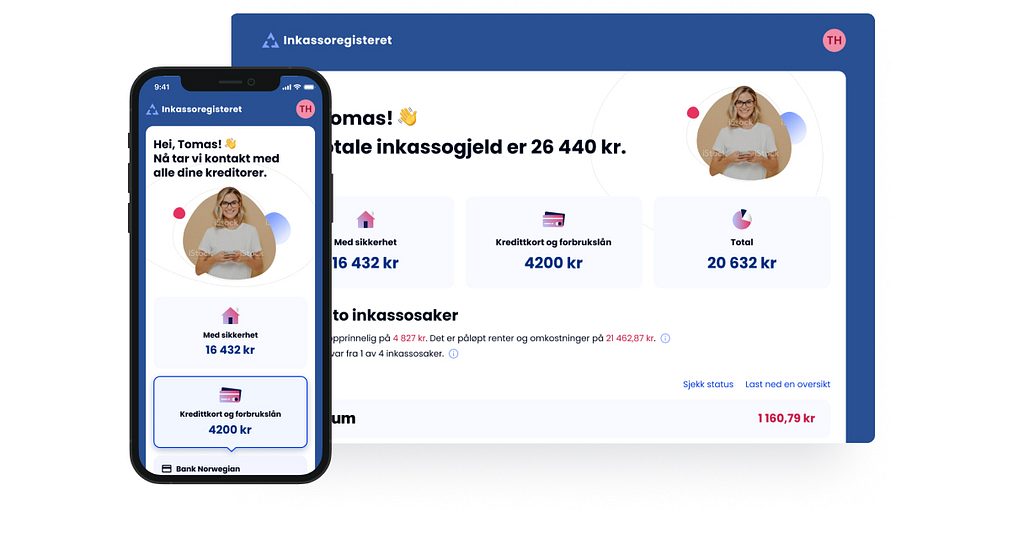

Inside Inkassoregisteret you get an overview of everything you owe, or didn't even know you owed.

Or perhaps misplaced?

# If you don’t the state will take everything you owe

When bills are out of sight, they may be out of mind. Until the government shows up. They are, in fact, a kind of collections enforcement squad. They have the complete picture, even if you don’t. And they will come after you for everything you own. Apartment? Gone! Boat? Gone! Car? Gone! Horse? Gone! They will bring with them everything you have worth over 100,000 NOK.

You can probably keep the TV.

If the value of your larger assets combined can't repay what you owe after buying 150 cars, a four-seated glider, a pond filled with carp fish, a brand new nose or loads of kebabs and coca-cola (all real examples) – then you have to pay a smaller amount every month for 17 years.

But you won't go to prison.

– Some people think they will end up in jail and that it will be an "easy" way to make amends, that they just can serve their sentence. But it has been decades since Norway abolished the so-called “debt prison”, says Kvadsheim.

– Some people also think they can just bankrupt themselves, but that doesn't work as a private person. But it can get real dramatic, you could lose your house, says Drange.

# This is where your digital identity comes into play

In 2007, when “Luxury Trap” started on TV3, the hosts discovered how cumbersome it was to collect all the information about the participants they wanted to appear on the show. It took a lot of time. And it had huge consequences.

– When we started Inkassoregisteret in 2020, a full twelve years later, we discovered that not much had happened in regards to digital identification. Even with the general rapid technological development in the world. But Signicat has made it happen, says Kvadsheim.

Both Kvadsheim and CEO Lene Drange often think about GDPR, digital privacy and both use a lot of energy and effort to make sure their product is as safe and sound as humanly possible.

– Our service is free for private people, but regardless of who you are and what you need from Inkassoregisteret, you’re required to log in. That is possible in a very safe and secure way with Bank ID, and this is what Signicat helps us with. They give us a key to make sure all the info is correct, which is a crucial element of our business. The second thing they help us with is making sure we get a signed power of attorney to gather our users information on their behalf, says Drange and adds:

– You can't beat the fact that it is a sign of quality that both of these two things are being delivered by a known and trusted player in the market.

# This is what bad debt does to people

Both Drange and Kvadsheim have received debt collection claims in their lives.

– Oh yes! they say with a smile.

–Having financial trouble can affect one's happiness, relationships, career and daily life, and it is very hard on people, and a very private issue. It is difficult to talk about it, and get help. When we are able to teach people how to solve their future economic problems and to see them feel extremely relieved, it truly feels great to be a part of their solution.

– In my case they sent the letter to our cabin! I'm not always there, so that laid there untouched for a long time. I have heard several similar stories, but If I or anyone had checked Inkassoregisteret, the debt would be visible there no matter where I am in the world, says Kvadsheim.

– Are debt collection companies a bit sly? Do they want it to be difficult, and to take some time?

Hallgeir Kvadsheim laughs.

– Well, they probably benefit from us being just the right amount of lazy.

– What does bad debt actually do to people?

– Having financial trouble can affect one's happiness, relationships, career and daily life, and it is very hard on people, and a very private issue. It is difficult to talk about it, and get help. When we are able to teach people how to solve their future economic problems and to see them feel extremely relieved, it truly feels great to be a part of their solution, says Lene Drange.

– Yes, there is definitely a connection between debt and psychological pain. But when we help people, they tell us their stress, headaches and stiff shoulders have loosened its grip. To help people with their economy gives us a lot of joy, says Kvadsheim.