Signicat and T-rank team up to overcome the UBO identification challenge

Signicats cross-border solution for identifying Ultimate Beneficial Owners (UBOs) is like no other and can make all the difference when searching for this elusive yet important information in KYB processes. In this blog post, we explain how it works and show where the advanced UBO-information from T-rank comes into play.

#

What is a UBO?

UBO stands for Ultimate Beneficial Owner and refers to natural persons who ultimately own or control the company according to specific criteria.

# Why would you need to identify the UBO?

In the global fight against financial crime, countries have jointly decided that financial service providers (like banks) need to identify the persons with significant control (in a business) before welcoming business customers.

This control process is called CDD (Customer Due Diligence), KYC (Know Your Customer) or KYB (Know Your Business) and is required by European AML directives and domestic laws.

# How can you identify the UBO?

In Europe, where the Anti Money Laundering (AML) Directive is a blueprint for most countries, companies can identify UBOs by calculating the integrated ownership percentages or voting rights of a person in an organisation.

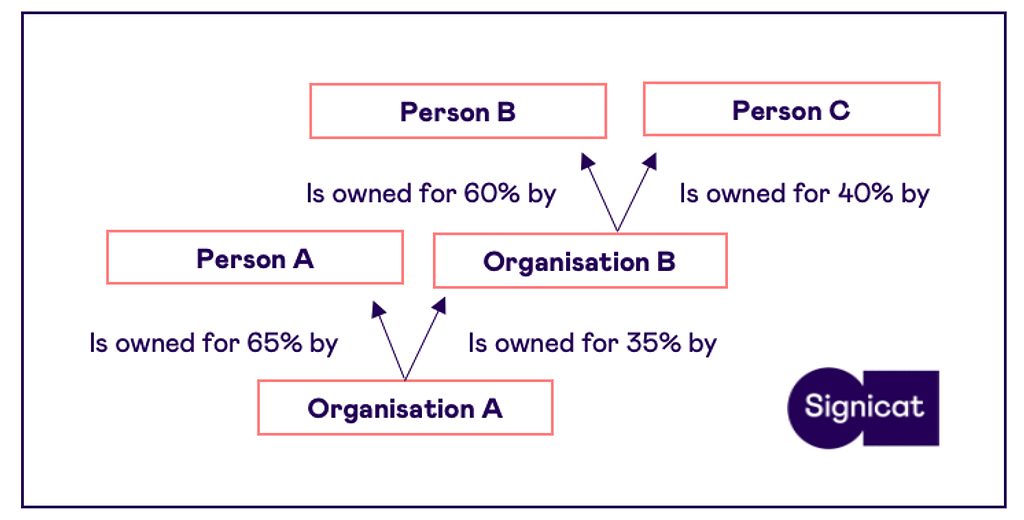

Individuals with an integrated ownership percentage above a certain threshold are considered UBOs. 'Integrated' means that the ownership percentages across different levels in an ownership structure are multiplied. A typical threshold value for UBOs in the EU is 25% integrated ownership. The image below illustrates how integrated ownership can be calculated.

#

Why is identifying UBOs so difficult?

The illustrated example of integrated ownership looks simple, but understanding someone's true ability to control an organisation can be complex.

Besides the ownership of shares, you must look into the voting rights related to those shares. In this way, you can determine the actual influence of a shareholder in an organisation. On top of that, ownership percentages can sometimes give a misleading impression of a shareholder's ability to influence the outcome of a vote.

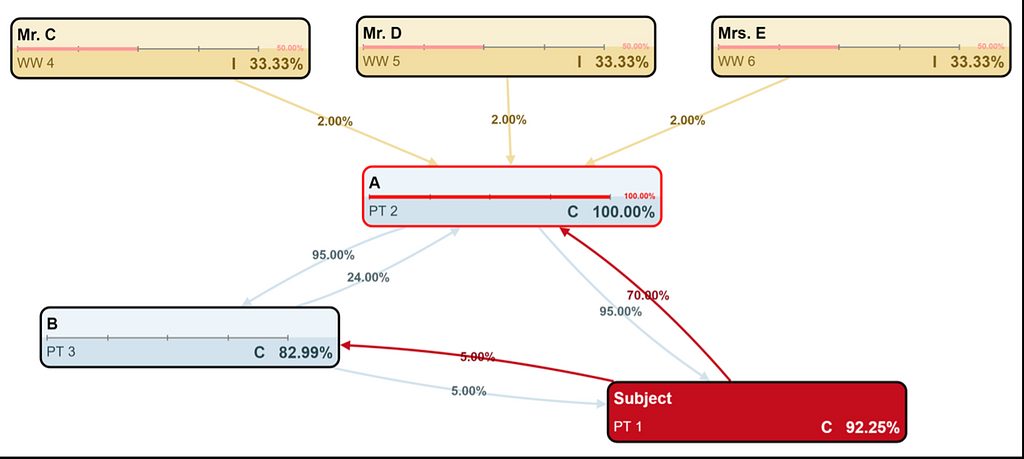

Take the example below, in which persons with minority voting rights (Person C, D, E only have 2% of the shares in A) can, in practice, still determine the outcomes of all possible voting scenarios in the subject organisation.

Another complexity is dealing with foreign entities or persons who own shares of a given company.

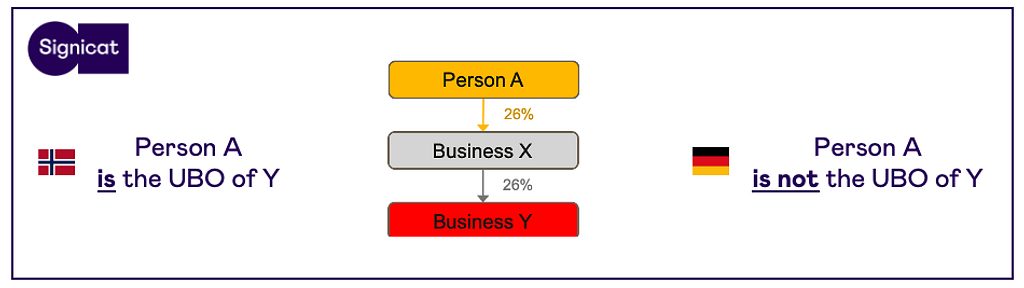

In that case, you must retrieve the data required for UBO identification from different registers across borders. On top of that, domestic laws in European countries use different definitions for UBOs. In practice, this means that calculating the integrated ownership depends on the applicable local regulation.

Finally, some organisations have no shareholders who fulfil the UBO threshold criteria. Here, board members or people with daily management responsibilities are identified as UBOs.

Overall, there is a lot of complexity involved in identifying UBOs. Fortunately, Signicat can take away this complexity with our cross-border solution that uses detailed UBO data from T-rank.

#

How will the data from T-rank help you in identifying UBOs?

Tap into the Signicat platform and receive all the valuable UBO information from T-rank. With this data, you can solve the above challenges and identify the correct UBOs:

Cross-border business ownership

Business ownership often involves entities across borders. T-rank and Signicat have integrations with a wide variety of international data sources, enabling UBO identification across almost any country in the world. Examples of data sources are public Nordic business registers and international commercial credit bureaus like Bureau van Dijk.

UBO identification calculation differs across borders

T-rank supports different calculation models and allows you to set your own threshold values, ensuring compliance with local regulations.

UBO identification requires complex ownership calculations

Different parameters and calculation methods can determine who has true control within an organisation. T-rank and Signicat provide all relevant parameters (example below), including voting power, to determine the UBOs.

#

Overcome the UBO identification challenge with Signicat and T-rank

- Different definitions in different countries

Our API supports different country calculation models and provides all relevant indicators (ownership, voting power) as generic output. - Cross-border business ownership

Get access to domestic sources (e.g. Aksjonæregister) or cross-border sources (e.g. Bureau van Dijk) through a single API. - Complex calculations

API supports direct & indirect (+circular) ownership and voting power.